Get the Right Fit: Medicare Supplement Plans Near Me

Get the Right Fit: Medicare Supplement Plans Near Me

Blog Article

Recognizing the Conveniences of Medicare Supplement in Insurance

Navigating the complex landscape of insurance policy options can be a complicated task, specifically for those coming close to old age or already enrolled in Medicare. In the middle of the selection of selections, Medicare Supplement plans stand out as a valuable source that can offer tranquility of mind and monetary safety. By comprehending the benefits that these plans supply, people can make educated choices about their health care insurance coverage and make sure that their needs are adequately satisfied.

Relevance of Medicare Supplement Plans

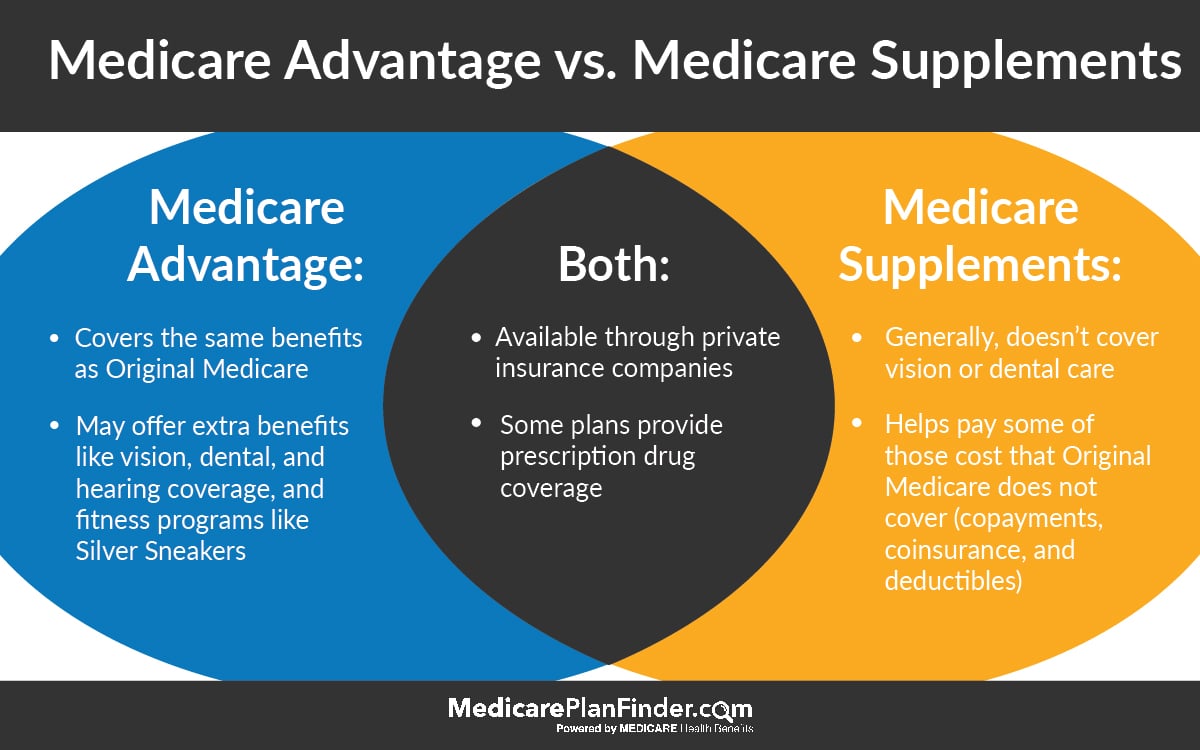

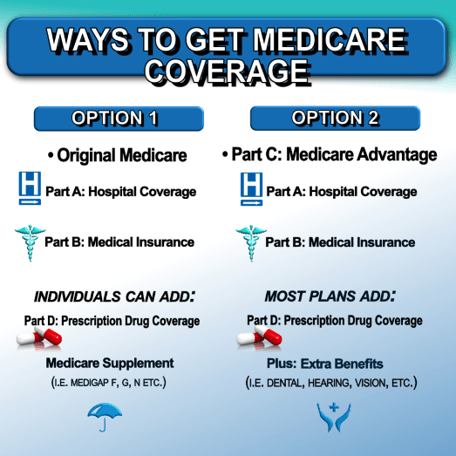

When thinking about medical care coverage for retired life, the value of Medicare Supplement Plans can not be overstated. Medicare, while thorough, does not cover all healthcare costs, leaving individuals potentially vulnerable to high out-of-pocket costs. Medicare Supplement Plans, additionally referred to as Medigap plans, are made to load in the voids left by conventional Medicare insurance coverage. These plans can aid cover expenses such as copayments, coinsurance, and deductibles that Medicare does not spend for.

Among the vital advantages of Medicare Supplement Plans is the assurance they supply by supplying extra financial security. By paying a regular monthly costs, people can much better budget for health care costs and stay clear of unforeseen medical expenses. In addition, these plans frequently provide insurance coverage for medical care services obtained outside the United States, which is not provided by initial Medicare.

Coverage Gaps Dealt With by Medigap

Addressing the voids in protection left by traditional Medicare, Medicare Supplement Program, also referred to as Medigap plans, play a vital role in supplying thorough health care coverage for people in retirement. While Medicare Component A and Part B cover numerous healthcare expenditures, they do not cover all costs, leaving beneficiaries vulnerable to out-of-pocket costs. Medigap strategies are made to fill these protection spaces by paying for specific health care prices that Medicare does not cover, such as copayments, coinsurance, and deductibles.

Among the considerable advantages of Medigap plans is their capability to provide monetary protection and comfort to Medicare beneficiaries. By supplementing Medicare coverage, individuals can much better handle their medical care expenditures and avoid unexpected monetary concerns associated to treatment. Moreover, Medigap policies provide flexibility in selecting medical care suppliers, as they are usually approved by any doctor that accepts Medicare job. This adaptability permits recipients to get care from a large variety of doctors and professionals without network limitations. In general, Medigap plans play a crucial function in making certain that retirees have access to extensive health care coverage and economic safety and security throughout their later years.

Expense Financial Savings With Medigap Plans

With Medigap plans efficiently covering the spaces in standard Medicare, one noteworthy benefit is the capacity for significant price financial savings for Medicare beneficiaries. These plans can help reduce out-of-pocket expenses such as copayments, coinsurance, and deductibles that are not completely covered by original Medicare. By completing these monetary holes, Medigap plans offer beneficiaries economic satisfaction by restricting their total medical care costs.

Furthermore, Medigap plans can offer predictability in healthcare investing. With dealt with month-to-month costs, beneficiaries can budget plan extra successfully, recognizing that their out-of-pocket prices are more controlled and constant. This predictability can be especially useful for those on dealt with revenues or limited budgets.

Versatility and Freedom of Option

One of the key benefits of Medicare Supplement Insurance, or Medigap, is the adaptability it uses in selecting medical care service providers. Unlike some handled treatment plans that restrict individuals to a network of doctors and health centers, Medigap plans generally enable beneficiaries to go to any type of health care provider that accepts Medicare.

In significance, the versatility and flexibility of choice afforded by Medigap plans make it possible for beneficiaries to take control of their health care decisions and customize their healthcare to fulfill their private requirements and choices.

Increasing Popularity Amongst Seniors

The rise Full Report in appeal amongst seniors for Medicare Supplement Insurance, or Medigap, emphasizes the expanding acknowledgment of its benefits in improving health care insurance coverage. As seniors navigate the complexities of health care options, lots of are turning to Medicare Supplement intends to fill up the spaces left by typical Medicare. The satisfaction that features recognizing that out-of-pocket expenses are reduced is a substantial aspect driving the raised rate of interest in these policies.

Additionally, the customizable nature of Medicare Supplement plans permits senior citizens to customize their coverage to fit their individual healthcare demands. With a selection of strategy options available, senior citizens can select the mix of advantages that finest aligns with their healthcare demands, making Medicare Supplement Insurance policy an attractive visit option for many older grownups wanting to secure comprehensive coverage.

Final Thought

Finally, Medicare Supplement Plans play a vital function in attending to insurance coverage gaps and conserving costs for seniors. Medigap policies give versatility and freedom of option for people looking for additional insurance policy coverage - Medicare Supplement plans near me. As an outcome, Medigap plans have seen an see this site increase in popularity among seniors who value the benefits and peace of mind that feature having thorough insurance coverage

Report this page